The thought of an IRS audit can be stressful, but the reality is that most taxpayers have a very low chance of being audited. The IRS primarily targets high-income earners and suspicious tax returns for closer scrutiny.

The Earned Income Tax Credit (EITC) is designed to help low- and moderate-income taxpayers, but it’s also a common source of incorrect claims. The IRS may flag returns for reasons like:

Most IRS audits do not involve in-person visits. The agency relies on correspondence audits, where taxpayers are asked to mail or upload supporting documents.

Surprisingly, IRS audit rates have declined over the past decade due to staffing shortages:

However, with additional funding from the Inflation Reduction Act of 2022, the IRS is hiring more agents and increasing audits for wealthy taxpayers.

The IRS uses automated systems and data matching to flag suspicious tax returns. Common audit triggers include:

Most taxpayers have little reason to fear an IRS audit. The odds of being audited are low, especially for middle-class earners. However, staying compliant by accurately reporting income and deductions is the best way to avoid unwanted IRS attention.

Tax debt is a growing concern for many Americans, often stemming from underreporting or underpaying taxes. Owing money to the IRS can be overwhelming, but you’re not alone—numerous resources and tax resolution services are available to help.

Tax debt refers to any unpaid taxes owed to the IRS, typically due to missed payments, filing errors, or unreported income. According to IRS data, around 858,000 Americans had delinquent tax accounts in 2017. The IRS provides multiple ways to determine the amount you owe, including online accounts, phone inquiries, in-person visits, or mailed statements.

The IRS enforces a 10-year statute of limitations on tax debt collection. However, penalties for underpayment can accumulate quickly. There are two primary types of penalties:

Failing to resolve tax debt can lead to serious financial consequences, including:

Despite these measures, the IRS prefers to work with taxpayers to find solutions rather than resorting to aggressive collection tactics.

If this is your first time owing the IRS, you may qualify for First-Time Penalty Abatement (FTA). To be eligible, you must:

Common reasons the IRS may approve an abatement request include:

If you fail to settle your tax debt, the IRS may take further action:

A tax levy can be released if it causes extreme economic hardship. However, you will need to provide documentation proving your financial distress, and you may still be required to set up a payment plan.

While the IRS is primarily focused on collecting owed taxes, they do offer relief options, including:

Even if you don’t qualify for full debt forgiveness, the IRS is legally required to allow you to retain enough income to cover basic living expenses.

Tax debt can be stressful, but understanding your options and taking proactive steps can help you regain financial stability. Whether through penalty abatement, installment plans, or professional assistance, there are multiple paths to resolving tax debt before it leads to severe consequences. If you owe taxes, act quickly to explore your best course of action and minimize financial strain.

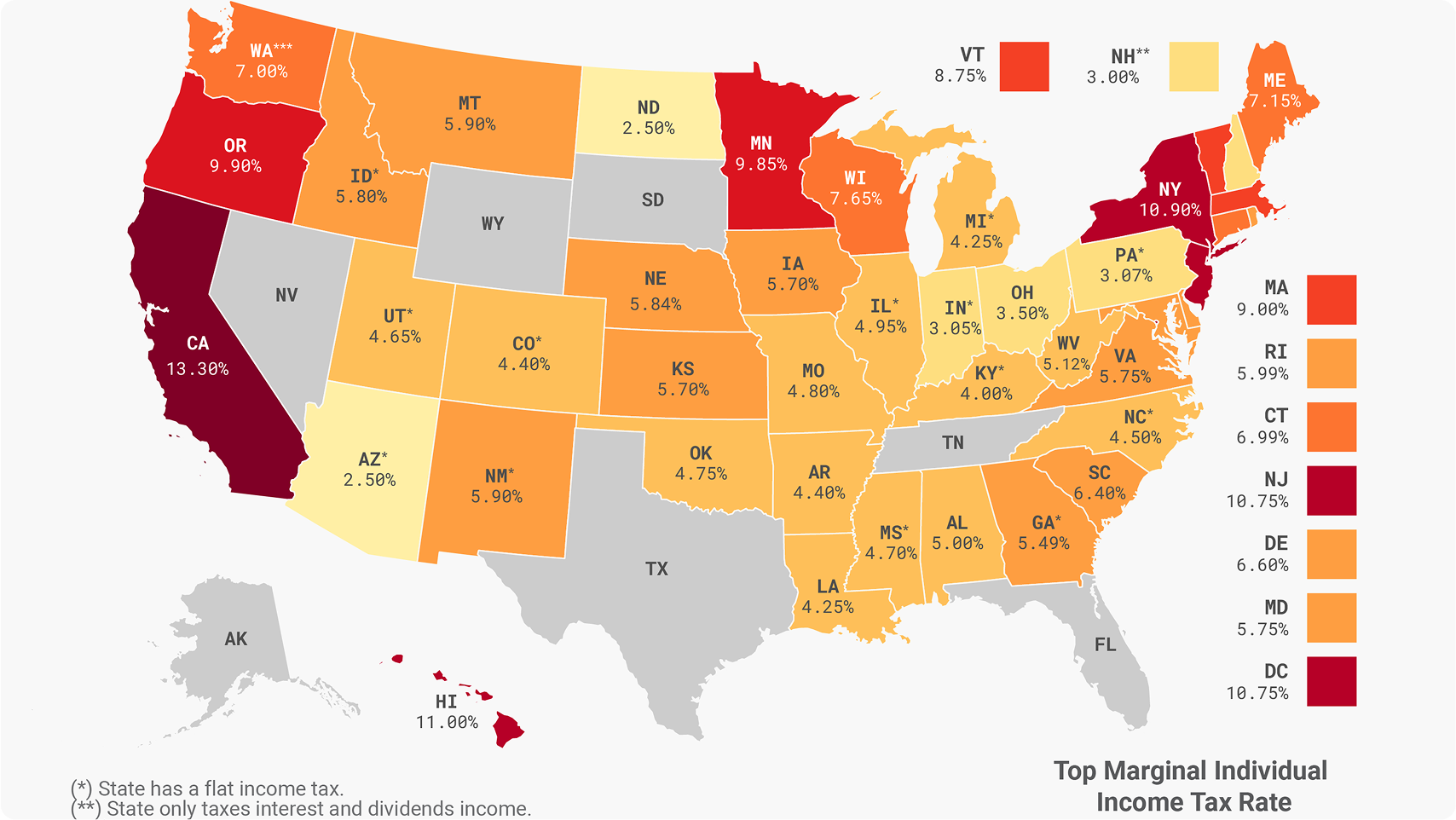

If you’ve fallen behind on state income taxes, you’re not alone. Many Americans are surprised by unexpected tax bills. However, ignoring tax debt can lead to penalties and increased financial burdens. The best course of action is to educate yourself and take proactive steps.

State income tax rules can differ significantly from federal income tax laws. Here are some key differences:

If you’re moving or unsure about your tax obligations, these nine states do not levy a personal income tax:

However, no-income-tax states may compensate with higher sales or property taxes.

If you fail to pay state income tax, consequences can vary by state but often include:

If you know you owe, don’t panic. Follow these steps to resolve your tax debt:

Falling behind on state income taxes can be overwhelming, but taking immediate action can prevent serious financial consequences. Whether you qualify for payment plans, hardship relief, or tax settlements, staying informed and proactive is the best way to manage tax debt effectively.

The IRS has announced its annual tax inflation adjustments for 2025, affecting over 60 tax provisions that will impact taxpayers’ 2026 tax returns. These changes aim to offset the effects of inflation on income, deductions, and tax credits.

For the 2025 tax year, the standard deduction will increase as follows:

These increases allow taxpayers to earn more before being subject to federal income tax.

The IRS has increased the income thresholds for all seven federal tax brackets:

Marginal tax rates apply only to income within each bracket. For example, a single filer earning $120,000 in 2025 will be taxed at different rates:

This means earning more does not subject all of your income to a higher tax rate.

The AMT exemption will increase to $88,100 for individuals and $137,000 for married couples filing jointly. Phase-out thresholds also increase to $626,350 (single) and $1,252,700 (married).

The IRS inflation adjustments help prevent taxpayers from facing higher tax rates due to cost-of-living increases. Understanding these changes can help with tax planning and optimizing deductions. If you’re concerned about how these changes will affect you, consider consulting a tax professional.

As the expiration of the 2017 Tax Cuts and Jobs Act (TCJA) approaches, lawmakers are at odds over whether to extend its provisions. While proponents argue that the tax cuts have been a lifeline for the middle class, critics claim they have primarily benefited the wealthy, labeling them a “Reverse Robin Hood” scam. With key tax breaks set to expire in 2025, the debate has intensified as Congress weighs the economic and political ramifications of continuing or modifying the law.

The Tax Cuts and Jobs Act (TCJA) was a sweeping tax overhaul signed into law by former President Donald Trump. It aimed to boost economic growth by lowering tax rates, increasing deductions, and making the U.S. tax system more competitive for businesses. The law reduced tax brackets, with the highest rate dropping from 39.6% to 37%, significantly cut corporate tax rates from 35% to 21%, and doubled the standard deduction, increasing it to $12,000 for single filers and $24,000 for married couples. Additionally, the Child Tax Credit expanded from $1,000 to $2,000 per child, while a $10,000 cap was placed on state and local tax (SALT) deductions, disproportionately impacting high-tax states like New York and California.

Supporters of the TCJA argue that allowing the tax cuts to expire would amount to a tax hike on millions of Americans. Without an extension, tax rates will return to pre-2017 levels, meaning families who have benefited from lower tax rates and increased deductions will see their tax bills rise. Additionally, they argue that keeping taxes low promotes economic stability, encourages consumer spending, and helps businesses reinvest in growth and job creation. Small businesses, in particular, have gained from the 20% deduction on pass-through income, which is set to expire unless Congress takes action.

The Congressional Budget Office (CBO) estimates that extending the tax cuts could cost the government around $3.5 trillion over a decade, but supporters believe the economic growth spurred by the cuts could help offset some of the lost revenue.

Opponents of the tax cuts argue that they primarily benefited the wealthy and large corporations while doing little to support working-class Americans. The richest 1% of taxpayers received the largest share of the tax reductions, while middle-class savings were comparatively modest. The law has also contributed to the federal deficit, which now exceeds $34 trillion, raising concerns about long-term economic sustainability. Furthermore, while corporate tax cuts were made permanent, the individual tax cuts were only temporary, set to expire in 2025 unless renewed. Critics argue that this was a deliberate design to prioritize businesses over individuals.

The effect of the TCJA on middle-class families is complex and varies based on income level, deductions, and state of residence. If the tax cuts expire, the Child Tax Credit could revert to $1,000 per child, reducing benefits for families, and the standard deduction would shrink, meaning many taxpayers would owe significantly more. Homeowners in high-tax states would continue to struggle with the SALT deduction cap, which limits their ability to deduct state and local taxes from federal returns. However, some middle-class households that benefited from lower tax rates under the TCJA may experience a tax hike if the law is not extended.

If Congress does not act, tax rates will return to pre-2017 levels. The lowest bracket will increase from 10% to 12%, while the 22% bracket will rise to 25%, affecting many middle-income earners. The highest tax rate will return to 39.6%, impacting wealthy individuals the most. Businesses will also lose several key deductions and credits that have incentivized investment and job creation.

The debate over tax policy is shaping up to be a central issue in the 2024 election cycle. Republicans argue that extending the tax cuts is essential for economic growth and financial security for middle-class Americans. Democrats, on the other hand, seek to modify the law to ensure wealthier individuals contribute a larger share of taxes. Some possible compromise solutions include making certain middle-class tax cuts permanent while increasing taxes on the wealthy, adjusting the corporate tax rate to recover lost revenue, and expanding the Child Tax Credit to provide greater relief to families.

As the expiration date for the Tax Cuts and Jobs Act approaches, lawmakers must decide whether to extend, modify, or let the law lapse. For some, the TCJA represents an economic boost that has supported American families and businesses; for others, it is a tax break for the rich disguised as middle-class relief. The debate over tax policy will continue to shape America’s financial future, and taxpayers should stay informed about the decisions being made in Washington that could directly impact their bottom line.

If you owe back taxes, you may wonder if tax debt forgiveness is possible. While the IRS sometimes eliminates debt entirely, relief programs exist to reduce or restructure what you owe.

Ignoring tax debt can lead to liens, wage garnishments, levies, and passport restrictions. The IRS has extensive collection powers, making proactive action essential.

While full tax debt forgiveness is not as often, options like Offer in Compromise, hardship relief, and payment plans can significantly reduce the burden. If you’re struggling, consulting a tax professional can help you navigate the best path forward.

As Californians continue to grapple with high living costs, Assembly Republicans have introduced a series of legislative proposals aimed at alleviating financial burdens on residents. Their newly unveiled cost-of-living package seeks to lower gas prices, reduce taxes on tips, and provide tax credits for low-income renters. While these measures promise relief for many struggling families, they face an uphill battle in California’s Democratic-controlled legislature.

One of the central issues targeted by the legislative package is high gas prices, which have long been a concern for commuters across the state. Assembly Bill 12, co-authored by Assemblymember Tom Lackey (R-Palmdale), proposes repealing California’s low-carbon fuel standard, a policy that critics argue contributes to higher fuel costs. Proponents of the bill contend that eliminating this regulation could prevent projected gas price hikes of up to 47 cents per gallon in 2025 and an average of 65 cents per gallon between 2031 and 2035.

Another notable proposal, Assembly Bill 1443, introduced by Assemblymember Leticia Castillo (R-Home Gardens), seeks to make tips tax-exempt for service workers, including bartenders, barbers, and rideshare drivers. Supporters argue that eliminating taxes on tips would provide financial relief for low-income workers who rely on gratuities as a significant portion of their income. The idea of tax-free tips has gained traction nationally, with both former President Donald Trump and Democratic presidential nominee Kamala Harris having expressed support for similar measures during the 2024 election.

With housing affordability remaining a crisis in California, Assembly Bill 838, introduced by Assemblymember Tri Ta (R-Westminster), aims to provide tax credits to low- and middle-income renters, particularly those earning $25,000 to $50,000 per year. Given that California has some of the highest rental prices in the country, Republican lawmakers argue that this bill would provide meaningful relief for struggling households.

Republicans are also pushing for a broad-based personal income tax cut. Assembly Bill 121, introduced by Assemblymember Greg Wallis (R-Bermuda Dunes), proposes a 1% reduction in personal income tax rates, lowering the current rate from 4% to 3%. Advocates of the bill believe it would encourage residents to remain in California rather than relocating to lower-tax states.

Despite the potential benefits touted by Republican lawmakers, these bills face significant opposition in California’s Democratic-majority legislature. Many Democrats argue that repealing fuel regulations could undermine the state’s environmental goals, while others question whether tax cuts for tips and lower personal income tax rates would disproportionately benefit certain economic groups without addressing broader systemic affordability issues.

At the same time, Democrats have introduced their own affordability-focused proposals, including measures to expand food benefits under CalFresh, increase free medical screenings for low-income students, and provide housing assistance for foster youth and homeless individuals.

The Assembly Republicans’ cost-of-living bills offer bold solutions to address some of California’s most pressing economic concerns, from rising gas prices to excessive taxation on working-class individuals. However, given the partisan divide in Sacramento, their success remains uncertain. As the debate unfolds, California residents will be watching closely to see whether any bipartisan compromises emerge to ease the financial strain on families statewide.

As the debate over tax policy heats up in Washington, Senate Republicans are pushing to make the 2017 Trump tax cuts permanent. While supporters argue that extending the tax cuts will provide economic stability and prevent tax increases for millions of Americans, critics warn that it could trigger a “debt spiral,” worsening the already massive federal deficit. According to estimates from the Congressional Budget Office (CBO), making these tax cuts permanent could add $4.6 trillion to the national debt over the next decade, raising alarms about long-term fiscal sustainability.

The Tax Cuts and Jobs Act (TCJA), signed into law by former President Donald Trump, significantly reduced tax rates for individuals and businesses. The law lowered the corporate tax rate from 35% to 21%, a change that was made permanent. It also reduced individual income tax rates, with the highest bracket dropping from 39.6% to 37%, and doubled the standard deduction, making it $12,000 for single filers and $24,000 for married couples. The Child Tax Credit was expanded, providing greater financial relief for families, while the State and Local Tax (SALT) deduction was capped at $10,000, a move that disproportionately affected high-tax states. However, while corporate tax cuts were made permanent, most individual tax breaks were set to expire in 2025, creating the current debate over whether to extend them.

Proponents of the extension argue that making these tax cuts permanent would prevent a tax increase for middle-class families, many of whom have benefited from lower rates and expanded deductions. They believe that maintaining lower tax rates will encourage job growth and investment by ensuring a favorable tax environment for businesses. Supporters also contend that the tax cuts have provided economic stability, allowing taxpayers and businesses to plan for the future without uncertainty. By keeping tax rates low, they argue that consumer spending will continue to rise, fueling economic growth and strengthening the overall economy.

Republicans have framed the issue as a choice between economic growth and higher taxes, asserting that failing to extend the cuts would result in millions of Americans facing a tax hike. They also claim that the economic activity generated by the tax cuts will help offset the revenue losses over time, mitigating the overall impact on the federal budget.

On the other hand, critics, including many Democrats and fiscal policy analysts, warn that making the TCJA permanent would lead to unsustainable deficits and force painful cuts to essential government programs. The Congressional Budget Office projects that extending these tax breaks would add $4.6 trillion to the federal deficit over the next decade, exacerbating an already concerning national debt that currently stands at $34 trillion.

Opponents of the extension argue that the tax cuts primarily benefited high-income earners and large corporations while offering only modest relief to middle-class families. They contend that preserving these cuts would ultimately require reductions in critical public services, such as Social Security, Medicare, and infrastructure investments. Additionally, they warn that allowing tax cuts for the wealthiest individuals to remain in place would worsen economic inequality, placing a heavier burden on working-class and lower-income Americans.

Some economists caution that while tax cuts can stimulate short-term growth, their long-term effects on government revenue could be detrimental. Without sufficient revenue, the government may be forced to make difficult trade-offs, such as reducing funding for education, healthcare, and other social programs, in order to manage the growing deficit.

The debate over making the Trump tax cuts permanent is shaping up to be a central issue in the 2024 elections. While Republicans in Congress largely support an extension, some Senate Republicans have expressed concerns about the impact on the deficit. Meanwhile, Democrats are expected to push for a compromise that extends only middle-class tax cuts while allowing corporate and high-income tax breaks to expire.

Potential compromises being discussed include extending tax cuts for households earning under $400,000 while increasing tax rates for wealthier individuals. Another possibility is revising corporate tax rates to recover some of the lost revenue, along with lifting the SALT deduction cap, which has been a contentious issue for taxpayers in high-cost states.

The fight over making the Trump-era tax cuts permanent reflects a broader debate about America’s fiscal future. While supporters see it as a way to protect taxpayers and boost the economy, critics warn that it could push the country deeper into a debt crisis, forcing difficult financial trade-offs. As lawmakers in the Senate and House negotiate, taxpayers should stay informed about how potential changes could affect their financial future. With 2025 fast approaching, the decisions made in Washington will have long-lasting consequences for millions of Americans.

While most Americans associate April 15 with the deadline for filing their income taxes, other important tax deadlines also fall on this date. Missing them can lead to penalties and interest charges.

If you’re self-employed, a freelancer, or an independent contractor, you must make quarterly estimated tax payments to the IRS. The first payment for 2025 is due on April 15.

Failing to make these payments can result in underpayment penalties and interest.

With more people earning money through gig work (Uber, Etsy, freelance services), understanding estimated taxes is critical. Unlike W-2 employees, independent workers don’t have taxes automatically withheld, making quarterly payments essential to avoid IRS penalties.

April 15 isn’t just Tax Day—it’s also the deadline for estimated tax payments, IRA contributions, and extensions. Staying informed about these deadlines can help you avoid unnecessary penalties and optimize your tax savings.

With Tax Day approaching on April 15, 2025, Americans are reminded of the substantial amount they pay in taxes over their lifetime. A recent study by Self Financial found that the average American pays $524,625 in taxes over their lifetime. However, in some states, this number is significantly higher.

The study includes estimates for various taxes, including income tax, property tax, sales tax, and taxes on goods such as food, clothing, and entertainment.

The U.S. federal tax system is progressive, meaning the more you earn, the higher percentage you pay. The seven tax brackets for 2024 range from 10% to 37%.

Taxes take up a significant portion of earnings over a lifetime. For example:

The burden of high taxes has led many Americans to relocate. United Van Lines reports that state-to-state migration increased from 7.4 million in 2019 to 8.2 million in 2022. The states with the highest out-migration rates include:

Meanwhile, low-tax states like Texas, Florida, and Tennessee are seeing an influx of new residents.

Nine states do not levy a state income tax, making them attractive for tax-conscious individuals:

However, these states may compensate with higher sales taxes, property taxes, or other fees.

Despite higher taxes, some residents prefer to stay in high-tax states due to:

Choosing where to live depends on balancing tax burdens with lifestyle benefits. If lower taxes are your priority, states like Florida or Texas may be ideal. However, if access to top-tier public services and job opportunities outweigh tax concerns, high-tax states may still offer significant advantages.

Understanding these trade-offs can help individuals make informed decisions about where to live and work for the best financial future.

With digital payment apps like Venmo, Cash App, and PayPal becoming more popular, many people use them for both personal and business transactions. As tax regulations change, it’s important to understand when these payments become taxable. The IRS has introduced new reporting thresholds that could impact millions of users. So, do you need to pay taxes on money received through these apps? Let’s break it down.

The 1099-K form is an official IRS document used to report payment transactions processed by third-party payment apps. If you receive payments for goods and services through Venmo, Cash App, or PayPal, you may be issued a 1099-K form. This form helps the IRS track taxable income that may have previously gone unreported.

As of 2024, users who receive more than $5,000 in business-related transactions will receive a 1099-K form. The IRS initially planned to lower the reporting threshold to $600, but implementation delays have resulted in a gradual rollout. In 2025, the threshold willa drop to $2,500, and by 2026, it is expected to be lowered to $600. These changes primarily impact freelancers, gig workers, and small business owners who rely on digital payment platforms.

Some states have stricter reporting requirements, meaning users may receive a 1099-K even if their earnings are below the federal limit. For example, in Illinois, the threshold is $1,000 if there are at least four transactions. In Maryland, Massachusetts, Vermont, and Virginia, the threshold is set at $600. It’s important to check local tax laws to ensure compliance.

Not all money received through payment apps is taxable. The IRS differentiates between business and personal transactions. Payments for goods and services, side gigs, freelance work, or business-related transactions are considered taxable income. However, personal transactions—such as splitting a dinner bill, receiving money from family, or reimbursing a friend—are not subject to taxation. To avoid misclassification, users should label personal transactions correctly.

Each payment app has specific tax reporting policies. Venmo and PayPal track transactions marked as “goods and services” and count them toward the 1099-K threshold. Cash App does not report transactions for users with personal accounts. Zelle does not report any transactions to the IRS because it is considered a bank-to-bank transfer service.

To prevent receiving a 1099-K unnecessarily, users should ensure they are using personal accounts for non-business transactions, avoid marking personal payments as business-related, and keep business and personal transactions separate. These simple steps can help minimize confusion when tax season arrives.

If you receive a 1099-K, you must report the income on your tax return. The process includes reviewing the total payments listed on the form, deducting business-related expenses to determine taxable income, and filing the appropriate tax forms, such as a Schedule C for self-employed individuals.

Consequences of Failing to Report 1099-K Income

Not reporting 1099-K income can lead to IRS audits, penalties, interest on unpaid taxes, and potential legal consequences. To avoid these issues, it’s best to report all taxable income accurately.

Common Misconceptions About Digital Payment Taxes

There are several misconceptions surrounding tax reporting for payment apps. Some believe that if they don’t receive a 1099-K, they don’t owe taxes, but this is false—any income earned is still taxable. Another common myth is that personal transactions are taxable, which they are not. Additionally, some assume they don’t need to provide their tax information to these platforms, but certain services require Social Security numbers or tax IDs for compliance.

Accessing and Filling Out a 1099-K Form

If you receive a 1099-K, you can download it from the IRS website. The form includes instructions on how to complete it, and if you are unsure, consulting a tax professional is recommended to ensure accuracy.

The Impact on Small Businesses and Freelancers

Small business owners and freelancers need to prepare for increased tax reporting requirements. As thresholds decrease, more individuals will receive 1099-K forms. Keeping detailed financial records and using tax software can help simplify the process and ensure accurate reporting.

Potential Future Tax Regulations

The tax landscape is evolving, and further adjustments to digital payment taxation may occur. Lawmakers continue to discuss the best approach to ensure fair reporting while avoiding unnecessary burdens on casual users. It’s essential to stay updated on any new tax regulations that may impact digital transactions.

Conclusion

Understanding how Venmo, Cash App, and PayPal transactions are taxed is crucial for anyone using these platforms for business. While personal transactions remain untaxed, business-related payments must be reported. Keeping proper records and staying informed about IRS regulations can help taxpayers remain compliant and avoid potential penalties.